Happy Saturday to my favorite readers in the world. Coming to you from Montecito, California.

This newsletter is dedicated to Susan Wojcicki, who passed away yesterday. Susan was a trailblazer for women in technology and an inspiration to millions. She oversaw the growth of the YouTube platform under Google as YouTube CEO (she was one of Google’s earliest employees) and she stepped down from her role last year. Without her leadership, Google would likely never have bought Youtube, and at the very least, YouTube would not be where it is today without her vision. Her legacy lives on through her family and lasting impact that she’s made throughout her storied career.

Susan Wojcicki

Biz & Culture: Articles of the Week

Gen Z loves the idea of a retirement before their actual real-life retirement. Sanner, who’s 27, works in HR management for a major automotive company, and says that she states that “Gen Z is interested in less traditional models of employment, in general,” she says. “I hope that as we become a bigger part of the workforce, mini-retirements become more doable and more normalized.” Between mini-retirements, “quiet quitting”, and “lazy girl jobs”, we are starting to see that this is not a one-off trend, but more of a generational desire to chill out.

The .0001-Percent Glow-Up (puck)

This article’s author, Lauren Sherman, doesn’t miss a beat. I’m enamored with everything that I read from her - she captures the best of culture and power and the entertainment industry (all of my favorite subject!!!). In this article, she discusses the recent wardrobe glow-up moments across the world’s most influential power players, including Melinda French-Gates, Jeff Bezos, and Mark Zuckerberg. I love getting my articles from Puck (this is not a paid sponsorship), I just love it so much.

We’re in a dating app recession, as dating app usage across Gen Z seems to be in the decline. Bumble now expects revenue to grow 1% to 2% this year, down from a prior outlook in the range of 8% to 11%. We can all remember that Bumble was the recent target of criticism for a series of ads in which it said celibacy wasn’t the answer, and they’ve said they are taking actions to reignite user growth. The ads, launched in late April, coincided with a redesign of the popular dating app.

Caroline Gleich, 38, is known to her more than 220,000 Instagram followers for both her climate activism and her mountain-climbing adventures, which have taken her through ski slopes in Argentina to the summit of Mount Everest. Her campaign for Senate began after taking a training course by a state-level organization devoted to helping more Utah women run for office. From there, she met someone at a campaign management firm who reached out earlier this year to ask if she’d be willing to run for Romney’s seat.

Even with the effort to switch to “X,” the persistence of the name “Twitter” in global brand communications employs the importance of understanding brand identity, maintaining consistency, and effectively communicating changes.

This Vanity Fair article fascinated me - especially as a Los Angeles resident and the constant comparison game that tech workers make to San Francisco’s vibrant tech scene. Los Angeles isn’t alone, many cities have aspired to be the next Silicon Valley. But in El Segundo—home to an upstart, male-dominated defense tech enclave—the founders are defining themselves in opposition to it. “This is not San Francisco lite,” says one, “or San Francisco plus a little bit of hardware.” A few weeks ago, I put out a video on Rainmaker; the founder of this company is Augustus Doricko, who is one of the leaders of the Gundo Bros community.

Startup Funding Closeups: Corporate Venture Capital (CVC)

Corporate Venture Capital (CVC) is a practice where large corporations make strategic investments in promising startups or emerging companies. This funding model usually makes more sense for companies that are building technology or another type of product that falls within the scope of a larger, legacy company.

How Corporate Venture Capital works:

Investment: Corporations set aside funds to invest in startups, usually in sectors related to their core business or areas of strategic interest.

Structure: Most companies create separate entities or divisions to manage these investments.

Goals: Unlike traditional VCs, CVCs often have strategic goals beyond financial returns, such as access to new technologies, market insights, or potential acquisition targets.

Funding Stages: CVCs can invest at various stages, from seed to late-stage rounds.

Involvement: The level of involvement can vary from passive investment to active partnerships, board seats, or co-development of products.

Benefits for startups:

Access to corporate resources, expertise, and networks

Potential for strategic partnerships or acquisitions

Credibility boost from association with established brands

Benefits for corporations:

Window into emerging technologies and market trends

Potential for financial returns

Opportunity to outsource R&D and innovation

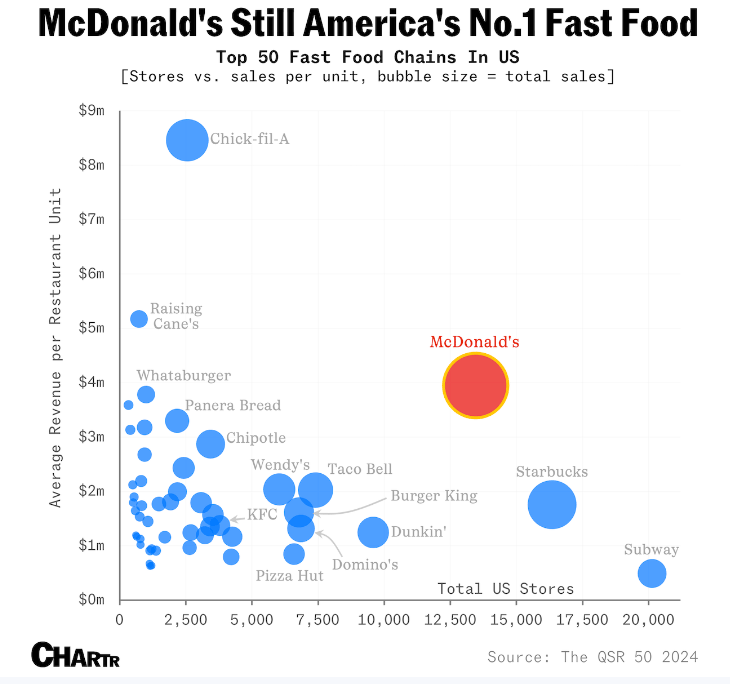

Mickey D’s: Still #1 in America

Chartr

The fast food industry is in a state of flux, with consumers balking at higher prices on the menus of some of the biggest names in the game. But, even with huge shifts in consumer behavior, when it comes to McDonald’s, America just can’t help lovin’ it. Indeed, in Monday’s QSR 50 report, a comprehensive annual ranking of US fast food chains, McDonald’s held onto the top spot thanks to its 13,457 outlets pulling in total sales of more than $53 billion (!!!) last year. Read the full article here.

Call Me, Beep Me

If you liked this newsletter, it would be very cool if you shared it with your family, friends or even a random person that you know who likes biz & culture content! Link to share here.

I seriously love chatting with you all; please feel free to send me a note on any of these platforms:

Email me at [email protected]

Follow me on Instagram

Follow me on TikTok

Follow me on YouTube

P.S. - If you see any typos in this newsletter, just know that I did it on purpose in order to make you giggle.

Collaborate/Sponsor This Newsletter

I’m always looking for new companies, people and stories to highlight. If you have any ideas for a future newsletter, please feel free to drop me a note.

xx Sammi